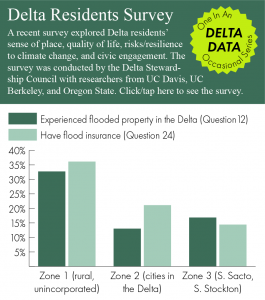

Survey: Only 21-36% of Delta Residents Have Flood Insurance. Question: How Can We Do Better?

Pretty much the entire Sacramento-San Joaquin Delta is a floodplain, where the chances of flooding in any given year are as high as 1 in 10 in some areas[1].

But the Delta Residents Survey found that only about a third of rural Delta residents and a fifth of Delta city dwellers have flood insurance.

Studies show households without insurance take longer to recover[2].

Given the risk, the number of households with insurance may seem low. But Michael Mierzwa, a civil engineer for the California Department of Water Resources, noted this is actually above average. Statewide, about 2% of property owners have flood insurance.

He said there are two likely reasons for the Delta’s higher participation rate: One is the Delta’s generational experience with flooding. Memories run long here.

The other is that mortgages issued in flood-prone areas require flood insurance.

But is this participation rate good enough in the flood-prone Delta? No, Mierzwa said, it should be 100%. “You need something in that area. Even if you’re levee protected, the levees are not foolproof.”

Why Don’t More People Get Insurance?

Kathleen Schaefer, a doctoral student in civil and environmental engineering at UC Davis, said research shows three things will get people to invest in flood insurance:

- The issue must rise to a level of concern. “The year we sold the most flood insurance policies in the state was the year of the Godzilla El Niño,” she said, referring to the winter of 2015-16.

- Their neighbor buys flood insurance or they know someone who has it.

- Flood insurance is affordable.

Affordability is a key issue in the Delta, where many of the small towns have high rates of poverty. This is why Schaefer has worked with the Delta Region Geologic Hazard Abatement District on a pilot program to provide inclusive flood insurance to property owners in Isleton.

Photos: Isleton flooded in 1972 following a levee break (photos: Department of Water Resources)

One goal of the program is providing a disaster recovery benefit in the event of a flood – a modest no-strings-attached payout to every property owner to help with the immediate costs of flooding, such as finding temporary housing in a hurry.

This is called parametric insurance, which provides a fixed benefit based on a pre-defined trigger, or parameter. For Isleton, it would pay if a sensor at the city’s wastewater pumping station detected more than 16 inches of water.

The payout would not be enough to cover the cost of repairing or rebuilding a flood-damaged home, Schaefer said, but the goal is to provide cash when households need it most.

And given that half of Isleton property owners don’t have flood insurance, Schaefer said, it’s a big improvement over the help people would get now. “Everyone pays a little, everyone gets a little,” she said.

She pointed out the National Flood Insurance Program doesn’t pay anything for alternative housing. And for what it does cover, the property owner must pay contractors with their own money first.

The Delta Region Geologic Hazard Abatement District

The pilot started two years ago when the city of Isleton formed the Delta Region Geologic Hazard Abatement District. Its boundaries are the same as the city’s, but it is a separate entity with authority for managing geologic and flood hazards.

The district was recently awarded pilot funding of $100,000 per year for two years by the Department of Water Resources. It will use the funding to work out the details, including how much the disaster recovery benefit will cost and how the money would be paid out.

The money can also be used to pay for the policy initially. But to get off the ground, the proposal will require voter approval, because property owners in the district would ultimately pick up the costs of the policy.

“The voters have to decide,” said City Councilman David Kent, who serves on the board of the district.

“What I want to do is make them a deal,” he said. “Your residence is in proximity of a 30-foot wall of water. The deal is the economy of scale at the government level can protect you. But it can’t do it without the standard mechanism of collecting funds.”

Schaefer puts it another way. “There are two certainties in life: We will all die, and levees will eventually fail. The big question is, which will come first?” she said. “We have life insurance to protect our families if we die before the levee fails. The goal of this program is to protect families if the levee dies first.”

Isleton as a Model

While parametric insurance is not a new concept, Kent said, funding it with a geologic hazard abatement district is. Only one other place has tried it – New York City – and that program has no long-term funding yet.

If Isleton is successful, the Department of Water Resources will be looking to apply what is learned there to other Central Valley communities interested in this kind of protection.

“The state’s role in this is to help them start the process,” said DWR’s Mierzwa. “What we get out of it is a community that’s more resilient, and we learn from the process and can help kick off community-based flood insurance in other small communities.”

The next Delta Region Geologic Hazard Abatement District board meeting will be held at 6:30 p.m. Nov. 20 at the Isleton Community Center. The public is invited to attend.

Further Reading

- Planning for Post-Disaster Housing in Legacy Communities – Identifying populations in the Sacramento-San Joaquin Delta historic communities at high risk of requiring temporary emergency housing (Delta Protection Commission, Delta Stewardship Council, Sacramento Regional Coalition to End Homelessness, Stanford University, UC Davis; 7/2/2024)

- With Flood Risk Rising, Can Community-Based Insurance Fill A Gap? (UC Davis, 2/26/2024)

- New report shows the U.S. insurance industry provides inadequate coverage for climate-related disasters (1/24/2023)

- Parametric Insurance for Disasters (PDF) (September 2020)

- California Climate Insurance

[1] Delta Adapts: Creating a Climate Resilient Future (PDF), page 71

[2] Inclusive Insurance for Climate-Related Disasters – A Roadmap for the United States (PDF)

Articles Exploring Delta Data